THE BLOG

THE BLOG

*This website uses affiliate links which may earn a commission at no additional cost to you. As an Amazon addict and Associate, I earn from qualifying purchases, but I'm only recommending products I love!

Browse More Blog Posts:

2025 Tax Deductions for Homeowners:

What You Need to Know

Author: Jamie Milam

Date: February 14, 2025

Disclaimer: I am not a tax professional or financial advisor. This article is for informational purposes only. Always consult with a qualified tax professional for tax advice and guidance specific to your situation.

Homeownership comes with several tax benefits. It's one of the many reasons I recommend for you to own rather than rent. Even though homeownership can have additional responsibilities (and costs) than leasing, you can offset many expenses through tax deductions while increasing your personal wealth through equity appreciation.

Before diving into specific homeowner deductions, it’s important to know the standard deduction amounts for 2025. The standard deduction is the portion of income not subject to tax that you can subtract before applying tax rates. For 2025, the standard deductions are:

- Single Filers: $14,600

- Married Filing Jointly: $29,200

- Head of Household: $21,900

If your itemized deductions—including mortgage interest, property taxes, and other eligible expenses—exceed these amounts, itemizing may provide greater tax benefits.

As a homeowner, understanding the tax deductions available to you in 2025 can help you maximize your savings. Whether you bought or sold a home in 2024, own a rental property, run a business, or have gone through a divorce, knowing what you can and cannot deduct is essential. Here's what you need to know about homeowner tax deductions this year.

If You Own (or Bought) a Home in 2024

Owning a home comes with several potential tax benefits, including:

- Mortgage Interest Deduction – If you financed your home, you may be able to deduct mortgage interest on loans up to $750,000 (or $1 million if the loan originated before December 16, 2017).

- Property Tax Deduction – Homeowners can deduct up to $10,000 in state and local taxes (SALT), including property taxes.

- Mortgage Points Deduction – If you paid points to lower your interest rate, you may be able to deduct them for the year you bought the home.

- Energy-Efficient Home Improvements – If you made qualifying energy-efficient upgrades, you might be eligible for tax credits, such as the Energy Efficient Home Improvement Credit.

- Home Equity Loan & HELOC Interest – If you took out a home equity loan or home equity line of credit (HELOC) and used the funds for substantial home improvements, the interest may be tax-deductible.

- Medically Necessary Home Improvements – If modifications were made to accommodate a medical condition, such as installing ramps, widening doorways, or adding an accessible bathroom, some of these expenses might be deductible as medical expenses.

Record Keeping Tip

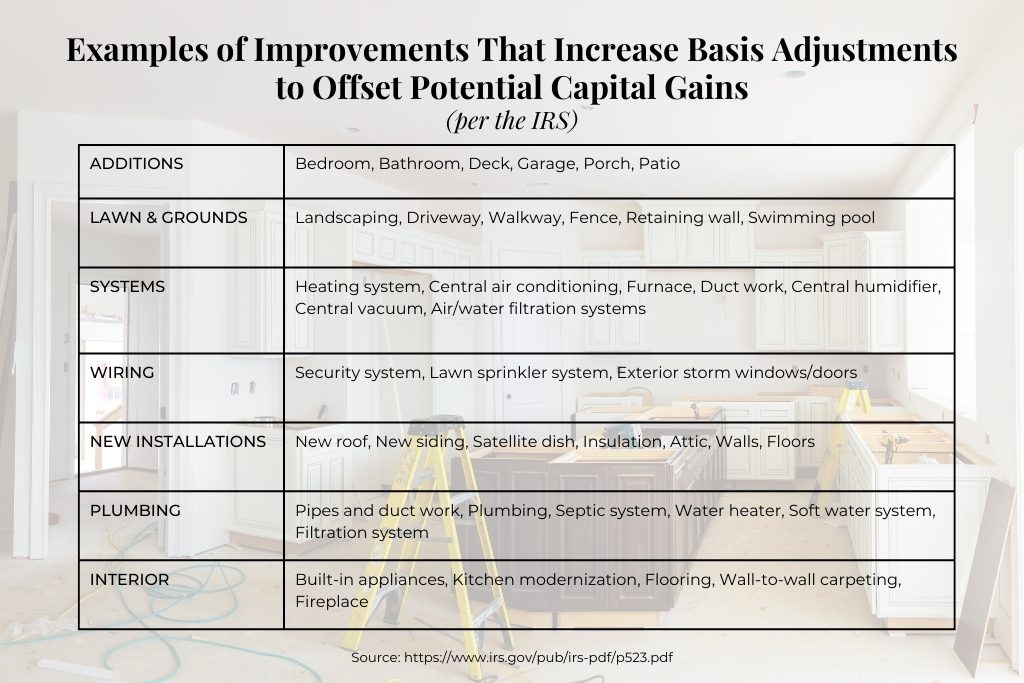

Keep detailed records and receipts for any major home improvements. These can be added to your home's cost basis, potentially reducing capital gains taxes when you sell in the future. Simply scan them in and save them on your computer or file them along with your other home and tax documents.

If You Sold a Home in 2024

Selling your home also has tax implications. Potential deductions or exemptions include:

- Capital Gains Tax Exclusion – If you lived in the home for at least two of the last five years before selling, you may exclude up to $250,000 in capital gains ($500,000 for married couples filing jointly). If your gains exceed these limits, keeping records of home improvements can help reduce your taxable amount by increasing your cost basis.

- Selling Costs Deduction – You may be able to deduct expenses such as real estate agent commissions, legal fees, state transfer taxes, recording fees and staging costs.

- Home Improvements and Repairs – Major improvements (not regular maintenance) may reduce your taxable gain. Permanent improvements that increase your home's value, such as adding a new roof, remodeling a kitchen, or installing energy-efficient windows, are only partly deductible. The deductible cost is reduced by the amount of the property value increase, meaning only the portion that does not contribute directly to your profit can be deducted. Additionally, maintenance and repairs made as part of selling the home, such as painting or minor fixes, typically are not deductible.

If You Own a Rental Property

Rental property owners can take advantage of several tax deductions, including:

- Depreciation – You can deduct depreciation on the structure (not the land) over 27.5 years for residential properties.

- Repairs and Maintenance – Expenses such as fixing a leaky roof or repainting are deductible in the year they are paid.

- Mortgage Interest & Property Taxes – Unlike primary residences, there is no $10,000 cap on property tax deductions for rental properties.

- Operating Expenses – Property management fees, utilities, advertising, and insurance may be deductible.

- Travel & Home Office Deduction – If you actively manage your rental, you might be able to deduct travel and a portion of your home office expenses.

Bonus Tip

It's extremely advised to consult with your tax professional before converting a primary residence to a rental property and vice versa to ensure you understand the potential tax implications of such a conversion. Similarly, if you're going to sell a rental property and are looking to defer the capital gains by purchasing another rental property, be sure to consult with your tax advisor and your real estate professional to understand the process of a 1031 Exchange.

If You Are a Business Owner

Homeowners who operate a business from their home may qualify for the home office deduction if they use part of their home exclusively for business. Deductible expenses include:

- A Portion of Mortgage Interest, Property Taxes, and Utilities – The percentage of your home used for business can be deducted from these costs, reducing your taxable income.

- Repairs Related to the Home Office – Any repairs that specifically impact the home office space, such as fixing an office window or painting the office room, are fully deductible. General home repairs that benefit the entire home, such as roof repairs, may be partially deductible based on the percentage of your home used for business.

- Depreciation of the Portion of the Home Used for Business – If you own your home, you may be able to deduct depreciation on the portion of the home used exclusively for business purposes over a set number of years.

- Office Furniture and Equipment – Items such as desks, chairs, computers, and printers used exclusively for business may qualify for a full deduction or depreciation over time.

- Internet and Phone Expenses – If you have a dedicated business phone line or a portion of your internet is used strictly for business, you may be able to deduct a percentage of these costs.

- Business Use of Vehicle – If you use your vehicle for business-related purposes, you may be able to deduct mileage or actual expenses related to its use.

If You’ve Gone Through a Divorce

Divorce can impact your tax situation, especially regarding homeownership. Consider the following:

- Filing Status – Your tax filing status is determined based on your marital status as of December 31, 2024. If you are still legally married but separated, you may file jointly or separately. If your divorce is finalized before year-end, you must file as either single or head of household (if you qualify). When unsure, refer to your final divorce decree or consult a tax professional.

- Mortgage Interest Deduction – If you and your ex-spouse still co-own the home, only the person making payments can deduct the interest.

- Capital Gains Tax – If you sold the home as part of the divorce settlement, you may still qualify for the capital gains exclusion. If ownership was transferred as part of the divorce, the recipient spouse assumes the existing cost basis for future tax calculations.

- Property Settlement – If one spouse retains ownership, they should keep detailed records of the home's cost basis for future tax implications.

What is Not Deductible

Here's a roundup of some standard expenses homeowners cannot deduct:

-

Personal Property & Home Furnishing: Any personal property, like furniture, clothing, or appliances, is not deductible, even if used in the primary home.

-

Homeowner’s Insurance: The cost of homeowner’s insurance is not deductible, unless you use your home for business purposes or it’s part of a rental property.

-

Personal Mortgage Insurance: PMI (Private Mortgage Insurance) for a personal home is not tax-deductible, though it may have been at some points in the past under certain conditions.

- Homeowners's Association Fees: HOA fees, nor special assessments are deductible.

-

Utilities: Unless you have a home office, utility bills for your personal home are not deductible.

-

Home Maintenance & Repairs: Routine maintenance or repairs (like fixing a leaky faucet, repainting, or lawn care) is not deductible.

-

Property Taxes on a Second Home: For primary residences, property taxes are deductible, but property taxes for vacation homes or second properties have limited deductions, depending on specific circumstances.

-

Mortgage Origination Fees: These fees are generally not deductible for personal home use (though they may be applicable to rental properties or business use).

Understanding homeowner tax deductions can help you save money, whether you’re a new buyer, a seller, a rental owner, or a business owner. A fantastic tax advisor can help you be proactive in creating a tax strategy to help you maximize savings.

If you're ready to take advantage of the financial benefits of homeownership or want to explore how selling your home could impact your bottom line, reach out—I'd love to help you navigate your options.

To taking the high road,

Looking to Buy in the Greater Charlotte Area?

Save this post to come back to or share with a friend!

About Me

I'm Jamie Milam, a determined AF woman who's embraced life after divorce by finding peace through self-awareness, intentional decision-making, and thrilling new travel adventures.

As a Realtor® in Charlotte, NC (and your connection to top agents nationwide), I’m passionate about guiding you through your homeownership and design goals—while also helping you create space for the things you love. My mission is to empower you to create a life of alignment too - at home, abroad, and within.

Whether it’s through real estate tips, home design inspiration, or solo travel experiences for divorced, independent women, I hope this space encourages you to discover deeper self-awareness and build a life that aligns with your passions and needs.

Have you scoped the podcast series that empowers women to make aligned decisions in a divorce?

Your Free Charlotte City Guide

Jamie Milam is a Realtor® in the Charlotte, NC area, licensed in both NC & SC, and has the ability to refer you to a number of agent partners across the nation, regardless of where you may live. She is an enthusiast for the power of awareness and believes it can be used in all facets of life to support aligned living.

**Disclosure** This post may contain affiliate links and they are at no additional cost to you, though I may earn a small commission. Don't worry, I only recommend products or services that I have tried or believe would be of great value to you! All opinions expressed are those of my own!

Recent Posts

There's More ▾

There's More ▾

Let me share the goods!

Come from contribution, that's a motto I've valued for years! So... that's exactly what I am to provide you, straight into your inbox each week! No fluff and all open-book. Inspiring you to practice awareness, value your authentic self, and implement strategic actions so you can create alignment in your world to live the life you desire and deserve!